Price Seeker v4 Official Release

We are excited. We already told you about it a few weeks ago and, finally, the day has arrived. After months of work, we launched

Price Seeker v4 and you can now contract it directly online,

from €49 per month + VAT (exclusive launch offer). Furthermore, if you want to try it first to convince yourself of its potential, you have a free 14-day demo at your disposal.

Our

rate shopper has undergone a comprehensive renovation to become a

comprehensive price intelligence platform and adapt, once and for all, to your needs as a

revenue manager.

We have no doubt that

Price Seeker was already one of the most powerful tools on the market in its segment. But we have always been very open to listening to those who are called to be its main users, and we are aware that certain aspects required a rethinking.

The keys to change

The

Price Seeker update has been undertaken from different sides. The objective, in addition to making it a

more intuitive and “hotel friendly” solution, was fundamentally to incorporate

new functionalities, visualization formats and indicators, more in line with current times and current work methodologies. Below, we detail some of the keys to the change.

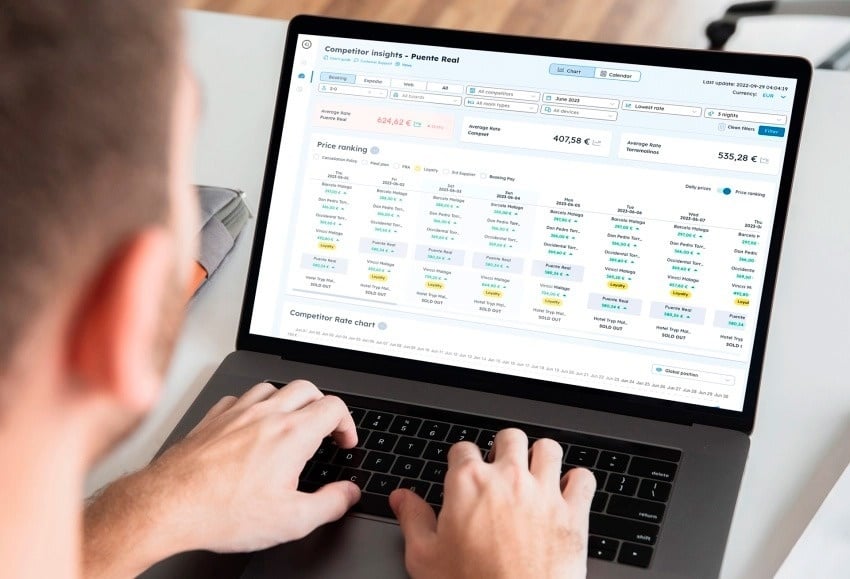

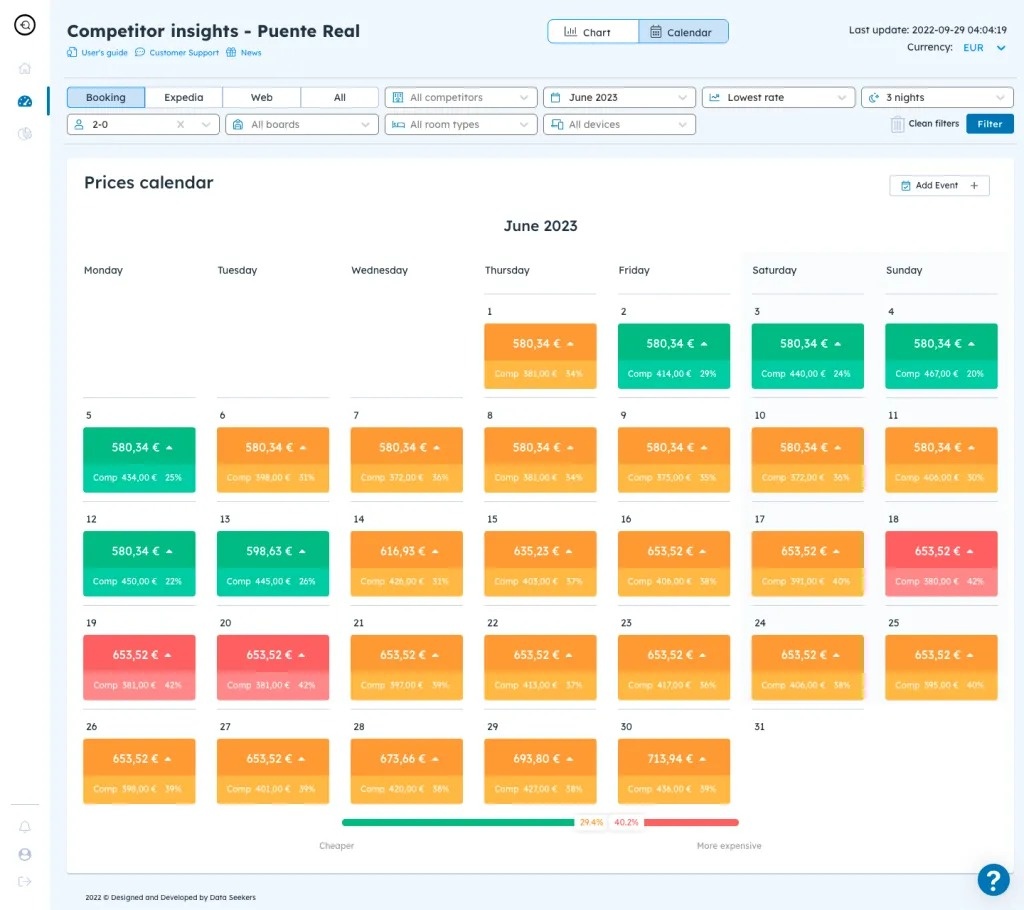

User experience

A simply fundamental point. And although you will have

tutorial videos and user manuals, it was important that, from the first moment, you were able to move freely through the different dashboards, and that the reading of the data was clear and simple. We've reordered elements, changed nomenclature and expressions, and introduced new display formats, such as calendar view. We hope you love the final result as much as we do.

New features

This point would deserve a separate article and, in fact, it will come. But, for now, we will limit ourselves to highlighting some of the most interesting new features.

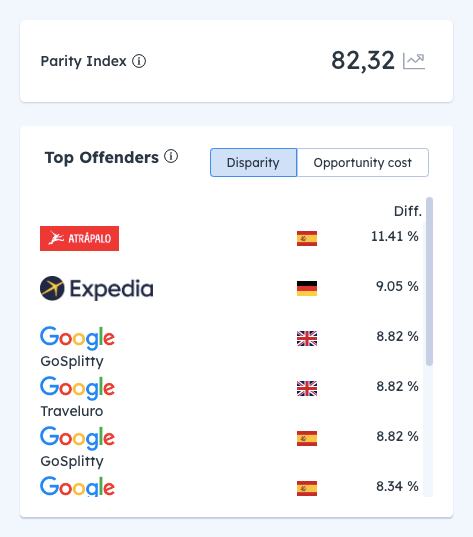

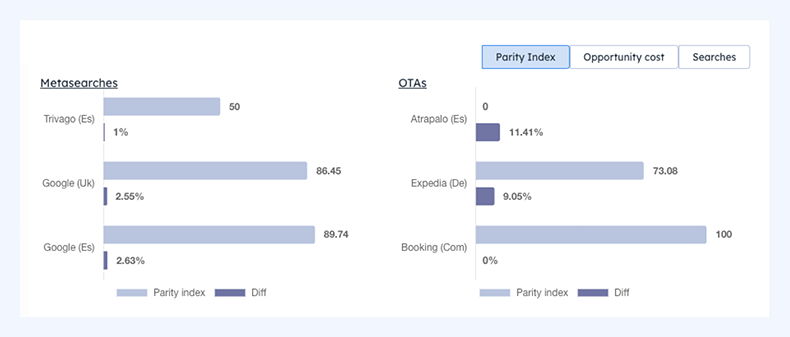

Opportunity cost

A proprietary algorithm, which takes into account different variables, will be responsible for telling you how much revenue the detected disparities are costing you. Because knowing that you have disparities is not the same as knowing how much they cost you.

Real Time Parity

One of the fundamental advantages of all our tools being developed internally is the fluid communication that is generated between them. In this case we use Rate Check, our metasearch engine inserted into the reservation process of your official website, to detect disparities in real time and monitor them through

Price Seeker.

Last Rooms Available

Knowing the availability status of your compset is a great competitive advantage that can greatly help you refine your pricing strategy. Now, with

Price Seeker v4 you will be able to detect when your competing hotels have only a few rooms available and use that information to your advantage.

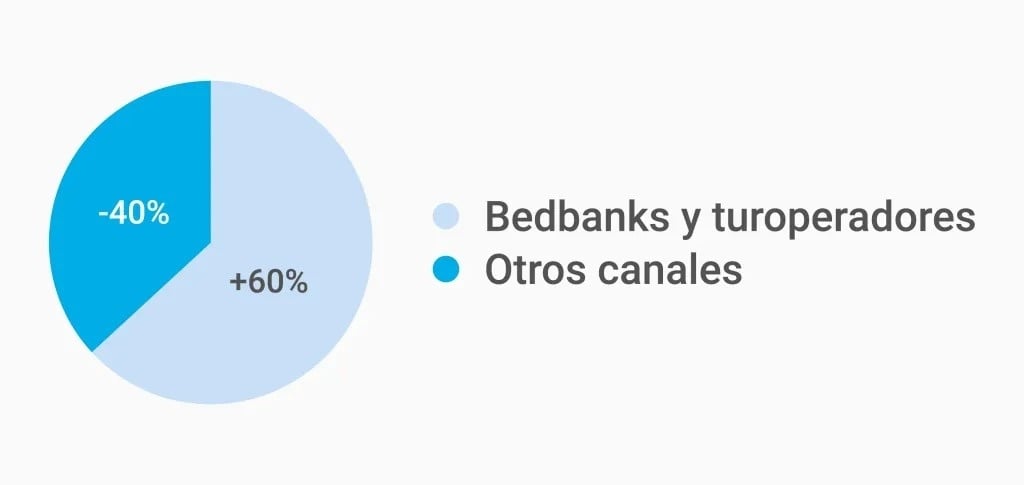

New indicators

In the first position of the ranking of new indicators we highlight the data related to

flight + hotel. To do this, we have implemented a module from our destination intelligence platform that extracts information from any

tour operation channel. We are talking about more than 200 websites, understood as data sources!

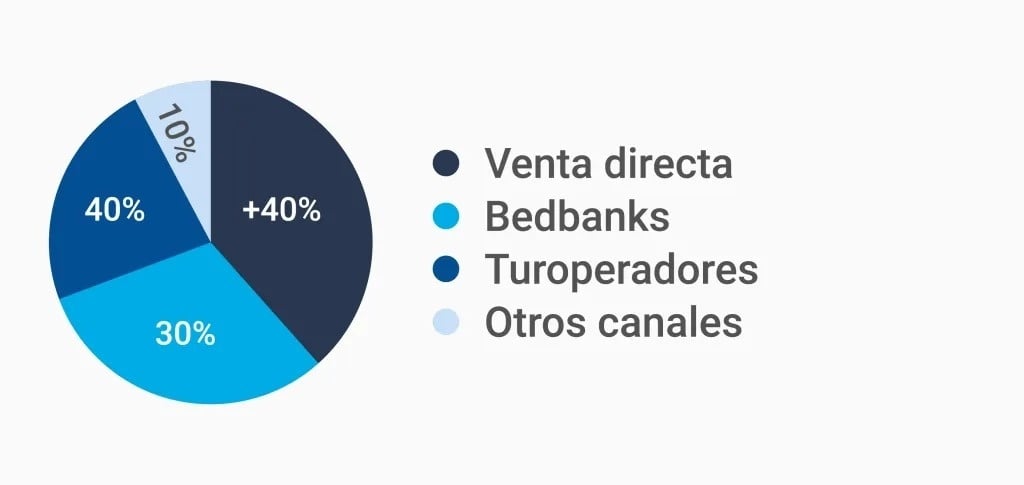

3 different packages and online contracting

Without a doubt, one of the great novelties of this new version of our rate shopper is the

bundling of functionalities. And each hotel or chain has specific needs. A vacation resort is not the same as an urban boutique hotel, to give two examples.

Therefore, now you have

three different packages, Professional, Advanced and Enterprise, and you can enjoy

Price Seeker v4 from €49 per month (VAT not included). A more than competitive price, within the reach of any type of establishment.

In addition, you can request your

free 14-day demo or

contract the tool directly online, by filling out a simple form. Once your user has been created, you will be able to access it to start consulting and analyzing data.

Price Seeker v4 will be one of the main novelties that we will bring to

Fitur 2023 , a fair where we intend to give a live presentation of the tool and offer you resources to test it in situ at our stand. You can find us in

Hall 8, Stand 8D15.

For any questions or further information, you can contact

Cindy Johansson directly, Sales & Project Manager of the tool: cindy@paratytech.com

Furthermore, according to the hotel occupancy index, 81% of accommodations were fully booked in the last week of July and 76% in the first week of August, significantly exceeding occupancy levels of previous years. Despite the price increase, the volume of reservations has not been affected. The average daily rate (ADR) for a room in France in July has increased by 21% compared to the previous year, reaching an average of around 583 euros, according to the OTP.

Furthermore, according to the hotel occupancy index, 81% of accommodations were fully booked in the last week of July and 76% in the first week of August, significantly exceeding occupancy levels of previous years. Despite the price increase, the volume of reservations has not been affected. The average daily rate (ADR) for a room in France in July has increased by 21% compared to the previous year, reaching an average of around 583 euros, according to the OTP. This behaviour could be interpreted as a strategy in which revenue managers concentrate so much on the event that, at the end, they opt for a relaxation in management, notes the Project Manager of Price Seeker. "We cannot determine with certainty the reasons behind this phenomenon, but the stable level of the data suggests that a significant flow of tourists is not expected in the French capital ," she adds.

This behaviour could be interpreted as a strategy in which revenue managers concentrate so much on the event that, at the end, they opt for a relaxation in management, notes the Project Manager of Price Seeker. "We cannot determine with certainty the reasons behind this phenomenon, but the stable level of the data suggests that a significant flow of tourists is not expected in the French capital ," she adds.

Up to here we can read... Follow us on our usual communication channels to be aware of new steps. Price Seeker v4 is coming very soon .

Up to here we can read... Follow us on our usual communication channels to be aware of new steps. Price Seeker v4 is coming very soon .